| Investment Home Calculator |

Created Date: 16-Jul-2019 |

| |

Last updated: 17-Jul-2019 |

| A

A

A

help

|

|

Disclosure, Warning and Purpose

This topic is NOT listed on this

Website as an endorsement to the information listed below and is NOT meant as

advising anyone to invest in houses for additional income. There

are always risks when purchasing anything that can be considered an investment,

which includes real-estate. This author and website do not give any

warrantee and guarantees of success by following any suggestions found in this

topic. All risks, concerning anything financial is absolutely the

responsibility of the investor and not this author.

The paramount concern by this author is

the deception

being portrayed by TV programs, Info-Commercials, Conferences and Books that

give the illusion that investment house purchasing is an easy undertaking with

guaranteed profits.

This is absolutely is not the case!!! In fact, even when everything goes

perfectly to plan, the investor needs to have a main source of income in the

early years to handle the many unseen costs that will arise such as:

- Major plumbing problems.

- Replacement of expensive Appliances like the water heater, refrigerator,

dishwasher, clothes washing machine and dyer.

- Replacement of a roof.

If you are not financially prepared to handle all of the costs that are

planned and have a good cash reserve, then do NOT become a house investor. This author has successfully, with

unquestionably God's guidance in every area that stopped many mistakes from

happening, has learned a great deal to help with some basic information, as a

starting place, for those who want to potentially

invest in houses as a source of income.

Many people hear about or know personally of individuals who made very costly

mistakes and experienced negative financial consequences when trying to buy

investment houses for the purpose of flipping. Flipping is a term that

means locating houses that are priced competitively, which can have improvements

done and then resold for profit. Many of the same problems in flipping

also are involved with investment houses that are obtained as long-term rental

income.

Summary

There are many Television Information Advertisements, Internet WebPages and

fun to watch TV Shows that show people doing very well by buying houses,

renovating the houses and then selling the houses for a nice profit. There

should be more warning and assistance to

prepare people from getting into this type of full or part time business.

It is this author's opinion that purchases of houses with a quick turn-around

sell is very difficult to make a profit. The better option is to purchase

houses that should be easily rentable, retain ownership for at least five or

more years before even considering selling.

Reality Points

Here are some very important points to consider before purchasing any

and all investment houses:

- Most house purchases will require updates to the kitchen, bathrooms,

landscaping and

possibly all other areas in the house, which is usually the primary reason that most "good

deals" on investment house purchases occur.

- The discounts on a house purchase plus the money to be spent to get the

house sellable will most likely make the investment not immediately sellable

because the profit will be minimal with realtor costs or renovations needed,

until the house gains value over time. As an example: Consider a

house, with all renovations needed is worth $200,000 where the purchase

price was $180,000. The purchaser spends $15,000 in renovations, so

the investment cost now is $195,000. If the purchaser wants to

sell the house, depending upon real-estate commission that can go up 8% of

value, then there would be a loss if sold. $200,000 minus commissions

of $16,000 would mean a loss of <$11,000>.

- TV Shows like to state that for every $1 spent, then it yields $2 or

more in

profits, but the problem is the potential of the renovations pricing the

house outside of the marketable value for the neighborhood. Using the

dollar figures of #2, as an example, consider the possibility of the current highest priced houses in a

neighborhood are $180,000 then trying to sell a house for over $180,000 is

often difficult to obtain.

- Many people who are in the "buy, fix up and sell quickly"

business are licensee realtors or real-estate lawyers (different

requirements in each State); and they have crews that fix up houses which

they pay on salary to save money or discounted volume type rates.

If these people are also realtors, then they save money or eliminate

commission costs and also can have commissions as part of the income when

selling a house. Additionally, these people have experience that makes

them better at estimating costs, knowing

what to renovate in a house and what neighborhoods to avoid.

- Most people, who are successful investors and not "flippers", that purchase

houses for rentals

know that it takes several years to offset the purchase and expenses of

having a house rental investment. The exception is locating a house

that is in extreme disrepair, that can be purchased for a very good price

and renovation costs guarantee at least a 3 to 1 profit margin for every

dollar spent.

- Most rentals do not make that much money or possibly do not make any

money on the rent paid in the early years of owning the house. The

income is a deferred type of income when owning a rental property because:

(a) the principle owed is paid down by the renter; (b) the home value, if

selected in the right market area, should be increasing in value of at least

3% per year or the house should have never been considered as a good

investment.

- A house investment that is intended for long term rental, should be

selected in an area which:

(a) the house values are increasing yearly;

(b)

there is low or no crime;

(c) there are schools nearby;

(d) the rent being

charged is comparable or just a little bit higher than what renters would be paying at a nice two bedroom

apartment;

(e) the rent being charged needs to cover the cost of mortgage,

property taxes, home owner association fees and around $2,000 a year in

potential maintenance requirements.

- Depending upon the area of the country that you are looking for

investment houses, the primary choice should be houses or Patio homes.

Condominiums and Townhouses can be bad investments in many parts of the

country where houses without shared walls to other houses are available.

In a downtown area of a major city where all houses are condominiums and

townhouses then is the exception. Additionally, Condominiums and

Townhouses usually have high Home Owner Association monthly fees compared to

free standing houses.

- Many novice investors make the mistake at looking at higher end houses

in upper middle class and higher income areas. Purchasing a house that

requires a high monthly rent to cover expenses which is subcutaneously

higher than competing apartments, will be a house that is most likely

difficult to acquire tenants. One month or greater periods of time,

without rent income, is difficult to recuperate.

- It is better to have a tenant paying perhaps $100 less per month than

the normal rate than have the house empty for several months. To

illustrate the point, consider an example of waiting to get even higher rent

will also show the financial loss for not accepting a tenant who would move

in immediately for less money. If the

house normally has a rate of $2,000/month and one month is lost, where a

tenant was willing to sign a one-year lease for $1,900 then the owner should

take the lease. The reason is if the house is empty for one

or more months, where the owner finally accepts a tenant paying an extra

$100/month at $2,100/month then it will take twenty months to make up the

loss of income for each month the house stayed empty.

- In many major cities, throughout the world, there have been increased

flooding of homes because of the increasing population. Empty fields /

areas that

use to absorb and hold water, but now has concrete infrastructures, will

have the water runoff into ditches, streams, bayous and eventually rivers

which ALL are not necessarily capable of handling the increasing amounts of

surface rain water run-off. It is important to NEVER buy an investment

house that has flooded or can be flooded. A house that has been

flooded is difficult to rent and also difficult to sell for the perceived

value from comparable homes that never flooded.

- No matter how experienced the investor, the cost of updating a house for

market or rental, is usually higher than expected.

- Renting a house should be a minimal of a one-year lease.

- Rental agreements and qualifying renters should be done by a

professional and experienced real-estate agent.

- You should require a deposit of at least one month in advance before

allowing the tenant to occupy the house. The deposit is usually the

commission to the realtor used and is also considered an expense that can be

deducted on taxes.

While this author is not stating that now I am an expert but I have had the

experience of completely renovating five houses for myself and assisting friends,

so I have become very experienced in the costs of renovations from the labor and

materials standpoint in the area that I live. Also, I have learned many

other important areas that have helped in the decision process for others.

The Benefits and How to Calculate

Download this Investment Home

Calculator Spreadsheet after reading the following section of this topic.

This is version 1 of the spreadsheet so there may be corrections to be made and

improvements.

The dollar figures are from an actual house purchase in the year 2014 and the

figures used are actual numbers with the profit obtained. The house purchase was for an 1800

sq/ft two story, 3 bedroom, 2 1/2 bathrooms, patio house in a middle-class income

area in Houston, Texas. The $18,000 in renovations included granite

counter tops in kitchen, granite counter tops in all bathrooms, new stove, new

refrigerator, new tile in master bathroom, master bathroom shower retiled, new

carpet throughout house, paint in every room and some other minor fixes.

The renovations took roughly 6 weeks to complete where there was wait

times involved

If this house was purchased in the outskirts of San Francisco and surrounding

cities, as a comparison, it would most likely cost over $1,000,000 in the year

2017 based on comparison done when I was there several times for vacations.

The renovations according to TV shows based in West Coast Cities would most

likely cost around $60,000 or more.

In a very well-known / famous TV show, concerning houses gutted and renovated

in the central part of Texas, this author is astounded at the costs involved for

the renovations given to the house buyers. The TV Show's Stars seem to be

awesome people, with a great vision on customizing, who I admire and like so

this is not trying to sound negative but to help people understand cost do not

necessarily have to be as high as seen on TV Shows. It is this author's

opinion, there has to be very large profits made by the stars of the TV show

where the buyers are getting their expertise in design, ability to select a good

location and a job done perfectly which most likely justifies the prices.

So for the investor's comparison, when adding up the cost involved on many of

the projects seen on that TV Show and Houston, the prices for materials and labor

are most likely very similar, so the cost most likely will be half or 1/3 of the cost if the investor

can select a good contractor and be familiar with labor / material pricing.

This author found an amazing contractor that did most of the work himself,

sometimes with day laborers, so this eliminated a major cost factor of

middle-men such as: (a) foreman and (b) projects full-time estimators. Note that

the $18,000 spent for items listed above, was estimated as high as $30,000

when using other contractors, which is still most likely 1/2 the cost of seen

based on what the costs are on the Texas TV show. Finally, regarding

selecting contractors, this author has found other contractors to do some big

projects over the last few years that were still half the cost of the Texas TV

show's disclosed costs for their buyers.

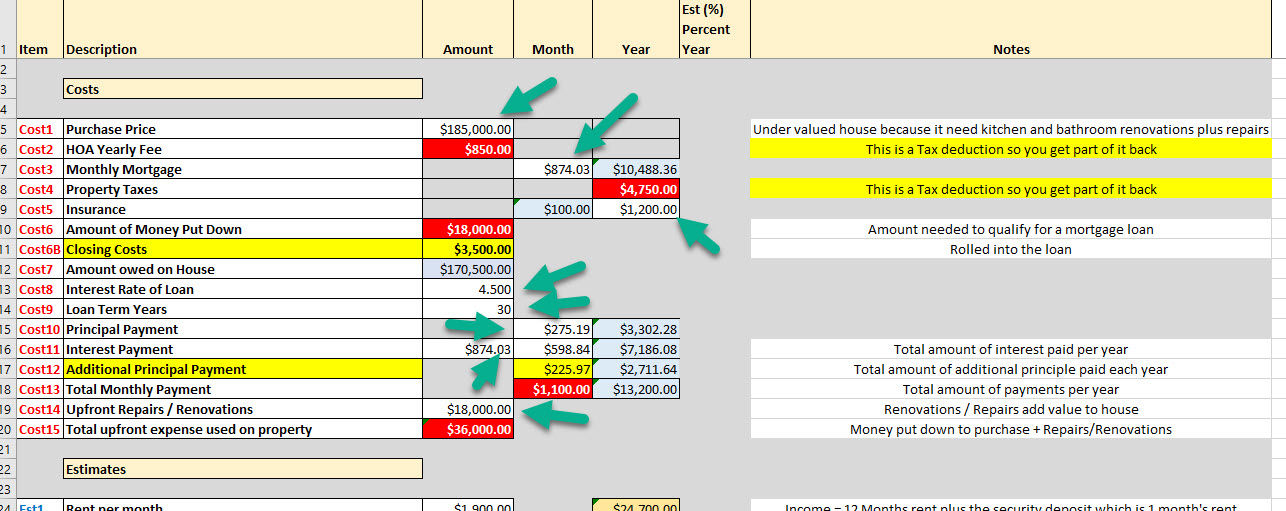

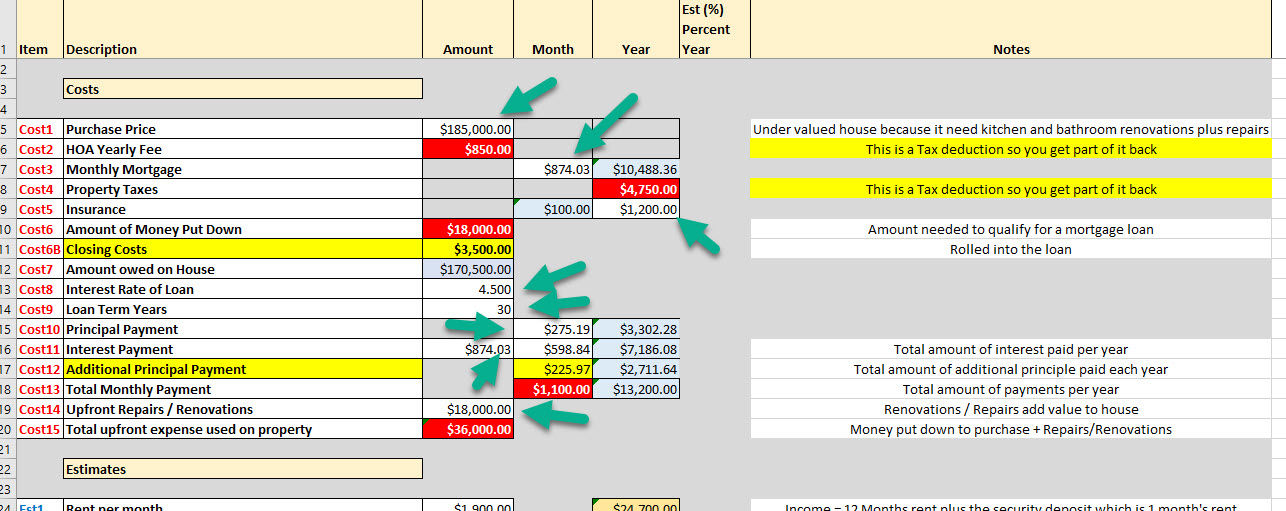

Step 1

Fill in all of the white cells and some of red cells that are editable. The

white cell indicates amounts that can change and the red cells indicate fixed

cost estimates. The interest rate of 4.5%, seen on "Cost8", was the going

rate for investment houses at the time of the purchase.

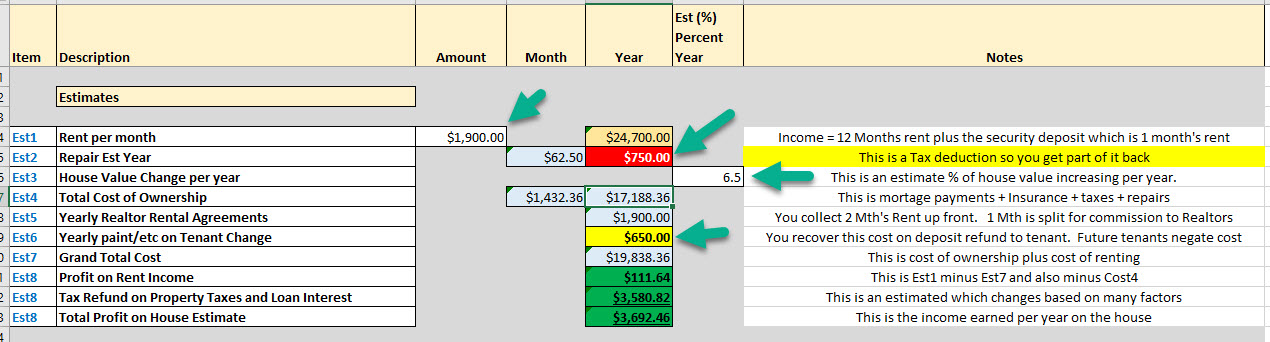

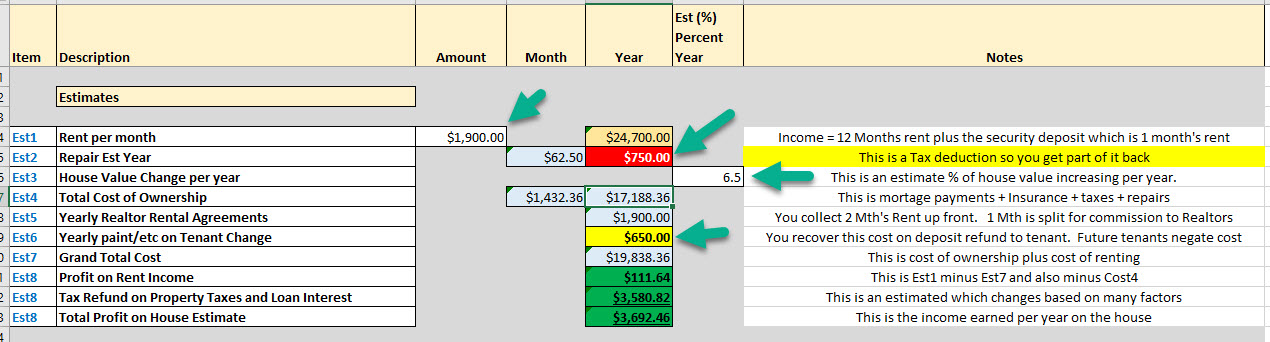

Step 2

Fill in the (a) estimated monthly rental, (b) the estimated house

appreciation value, (c) the estimated yearly repair costs, and (d) the estimated

repainting costs.

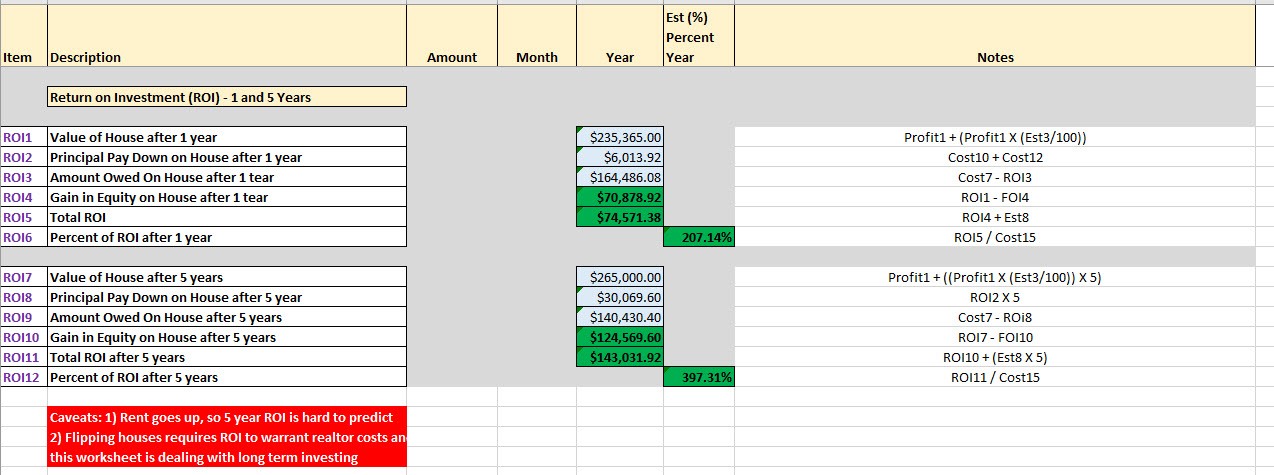

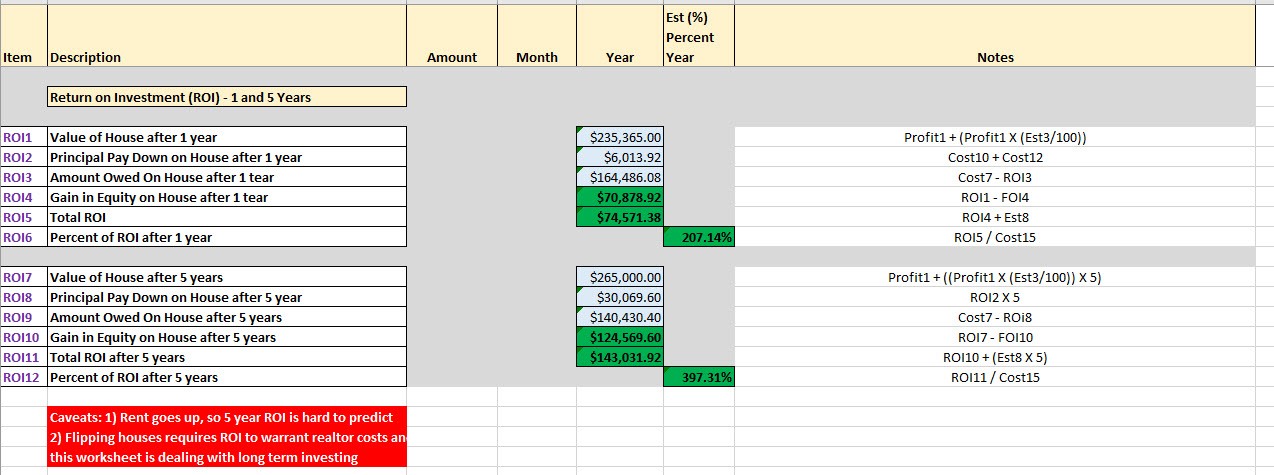

Step 3

Review the Return on Investment (ROI) to decide if the purchase is worth the

expenditures and time.

What can be deducted on Taxes?

- Advertising / Marketing

- Maid / Cleaning Services

- Commissions to Realtors

- Depreciation

- Home Owners Association Fees and Dues

- Insurance Premiums

- Property Taxes

- Management Fees. Depending upon your situation, it might be an

option to set up your own Management Company and pay yourself a salary or

hourly wage. Consult your Tax Professional on regulations. This

author was instructed that it is not going to be allowed by the IRS for my

business model and the difficulty is the IRS will not allow a business loss

filing for the rentals when a Management Company is involved which is

supposed to keep rentals occupied.

- Any and all exterminating expenses like Pest Control

- Renting equipment to maintain the property

- Purchasing equipment to maintain the property

- Any all repair work

- Any and all supplies that can include office supplies that are used in

the property management

- Trash Service Fees

- Electrical, Natural Gas, Water, Sewage Fees

- Yard Maintenance

- Anything that was a cost involved on the house